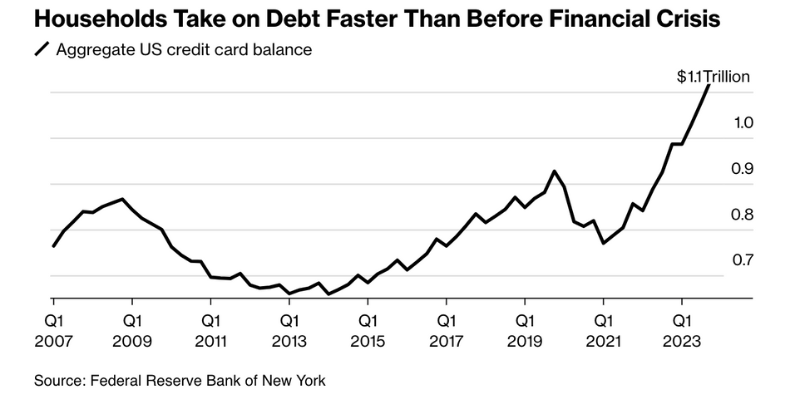

Middle class housing crisis amid soaring debt levels

Debt is holding down American families

Households feeling strangled by debt affects all housing segments. Debt-to-income affects rental qualifications, land-lease community approvals as well as mortgage applications. Buying a home for many seems more impossible than ever. Yet rents are escalating!

American debt stings like never before for new era for households

- Bloomberg.com

"After years of managing household budgets through the stress of the worst inflation in a generation, US families are increasingly pressured by a different kind of financial squeeze: The cost of carrying debt.

Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments."

Low Inventory and Affordability Crisis

As if high interest rates and rising debt isn't enough of a challenge, lack of available homes has supported higher values for both rentals and home purchases.

What are some solutions?

Land lease communities offer a quality, affordable lifestyle where you can enjoy the benefits of new construction for less than the cost of a rental. Choose a home already set and ready to move in - or be your own developer! Select your site, choose your model, enjoy!