"Rentification" of America - Long Term Housing Crisis

The American Dream - killed by Wall Street?

Home ownership has been the cornerstone of "the American dream" since the founding of our country. As Robert Kennedy said, "you work hard, you play by the rules and you're goig to be able to afford a home." Equity growth in real estate has been a key source of American generational wealth - literally for centuries.

However, during the past 20 years real estate has been impacted by unprecedented Wall Street dynamics starting with the 2008 mortgage crisis - created by Wall Street.

Who benefited? Wall Street investment firms who purchased foreclosed single family home portfolios, turning them into rental properties.

Fueled by the success of this strategy, firms like Blackstone ramped up their investments in single family homes during COVID creating all cash bidding wars which pushed traditional home buyers out of the market. Advanced AI analysis super charged national acquisition strategies.

In discussions on Clubhouse in 2020 and 2021, I heard insights into the "backstory" on this dynamic directly from Wall Street REIT fund managers and AI consultants who provided Wall Street firms with advanced market analysis using algorithms to support massive acquisitions which sent the real estate market into a tail spin.

In addition to purchasing homes listed publicly through subsidiary LLC's, distressed property loan portfolios were acquired by Wall Street acquisitions - why foreclosures on the market are down. Not because there aren't distressed homes.

They are purchased by REIT's before ever hitting the market. An example of this is highlighted in the video

below regarding Blackstone's purchase of Signature Bridge Bank's $17B distressed real estate portfolio.

Wall Street's acquistion of distressed single family portfolios during COVID was confirmed by various inside sources. Although I provided details and contacts to a top-tier national real estate reporter, it remains an untold story.

All Cash Bidding Wars during COVID

Ironically, the all-cash no inspection bidding wars during this time fueled the backlash against realtors as seen in recent NAR national lawsuits. The untold story rests on Wall Street's acquisition strategies, pushing home buyers out of the market and creating a false perception regarding listing agents' value proposition.

Homes were selling with multiple offers as soon as they were listed. It makes sense that sellers would be upset about commissions. But it wasn't realtors or how they are paid that created this market dynamic.

Blackstone's Big Bet on Affordable Housing

An in-depth overview explaining the "Rentification of America" and Wall Street acquistion dynamics going back to 2008:

Video highlights:

- 3:29 - Investors bought 26% of the country's most affordable homes in the 4th quarter of 2023

- 4:02 - Wall Street in the housing market

- 4:19 - Investors paid $36B on more than 200,000 single family homes between 2011 and 2017

- 4:52 - 60 Minutes - Wall Street buying modest single family homes and turning them into rentals

- 5:21 - Blackstone Group overview

- 7:21 - Blackstone acquires Tricon Residential in May 2024

- 8:16 - Blackstone acquires AIR Communities - closing Q3 2024

- 9:05 - Blackstone acquires Signature Bridge Bank's $17 Billion real estate loan portfolio

- 9:49 - Blackstone and the 2008 housing crash

- 11:57 - In 2012, Blackstone secured over $13B from investors, splurging $150M a week on property shopping

- 12:07 - Blackstone merged with Starwood creating the largest single family landlord in 2017

- 12:22 - Nov 26, 2019 - Blackstone cashed out all their stock in Invitation Homes for $17 Billion

- 12:33 - Blackstone made $7B between 2017 and 2019 in the single family home rental market

- 13:00 - CNBC - Institutional investors could own over 40% of single family homes by 2030

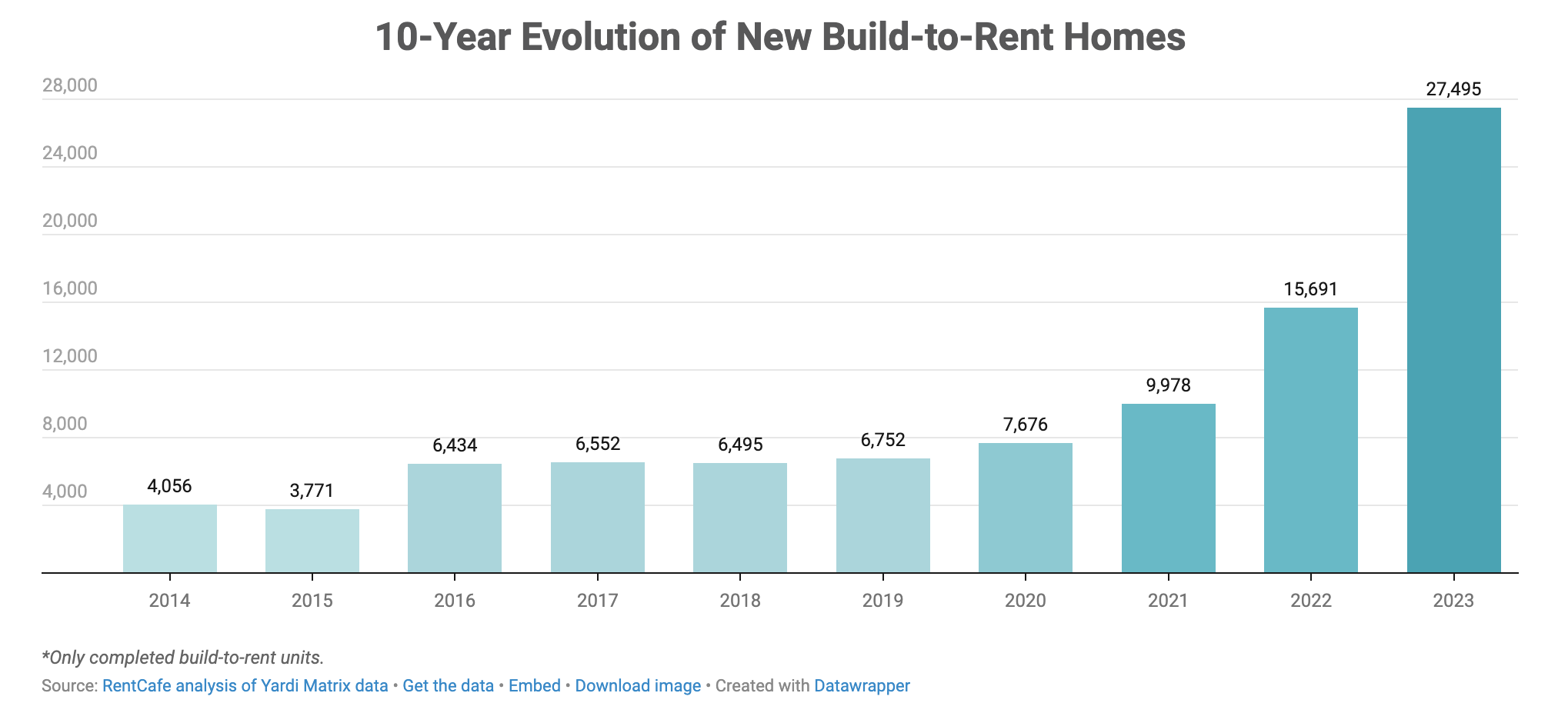

Build-to-Rent Houses Reaches All-Time High

There's a huge investment in keeping you renting vs building wealth as a home owner.

- The Build-to-Rent Housing Boom: New Single Family Rentals Reach an All-Time High with Another 45,000 on the Way - RentCafe.com

Lance Lambert recently reported in his ResiClub Newsletter ;

"Even before the onset of the Pandemic Housing Boom, homebuilders were constructing more single-family and townhome rental communities. Ultra low rates and soaring rents during the pandemic coupled with cash-flush Wall Street firms seeking assets to buy, of course, only added fuel to the fire."

Middle Class Rent Crisis

- Inflation is Scrambling Americans' Perception of Middle Class - Business Insider

"...With mortgage rates hovering close to a 23-year-high and home prices are near-record levels , Americans need to earn 80% more than they did before the pandemic to comfortably afford a home . First-time homebuyers, meanwhile, made up less than a third of all home purchases in 2023 , one of the lowest shares ever recorded, according to the National Association of Realtors...."

Lance Lambert , ResiClub author also reports:

"Bloomberg reporter Patrick Clark reported that Miami-based BGO, a real estate manager majority owned by Sun Life Financial Inc., will partner with 1Sharpe Capital to commit $500 million to an effort to purchase communities of single-family rental homes directly from homebuilders.

This build-for-rent investment comes just one month after we learned that Pretium raised $1 billion to acquire single-family rental homes from homebuilders.While these two announcements don't signify a return of the pandemic-era institutional bull rush, they do demonstrate that build-for-rent as an investment class is here to stay."

Alternative Affordable Home Ownership Options

Manufactured homes are surging in popularity as an affordable option to avoid increasing rental prices and enjoy the benefits of home ownership.

Well-managed communities offer quality of life, privacy and security associated with home ownership. While mobile homes have historically been viewed as a depreciating asset, that isn't the current market dynamic.

Location matters, as with all real estate. Some communities earn the tarnished reputation of "trailer parks." However, many are on a par with suburban subdivisions in terms of quality of life.

As an example, I recently sold this 1-year old gorgeous 3 bd / 2 ba home in a 55+ community located in Hershey for $130,000.

Lack of inventory?

Whether it's a renovated older home or a brand new model home, the cost of ownership in a land-lease community is often less than a 1 bedroom rent in most Central PA areas.

You can be your own developer - select a lot in a community you want to live in. Then customize your brand new home and schedule placement on your lot. When we meet, we'll go over all the options for making your home ownership dreams come true!

Susanna Kunkel, Realtor

484-416--0567